Retail deals in the UK succumbed to the fourth month straight in August, yet individuals invested more energy eating and drinking in bars and cafés.

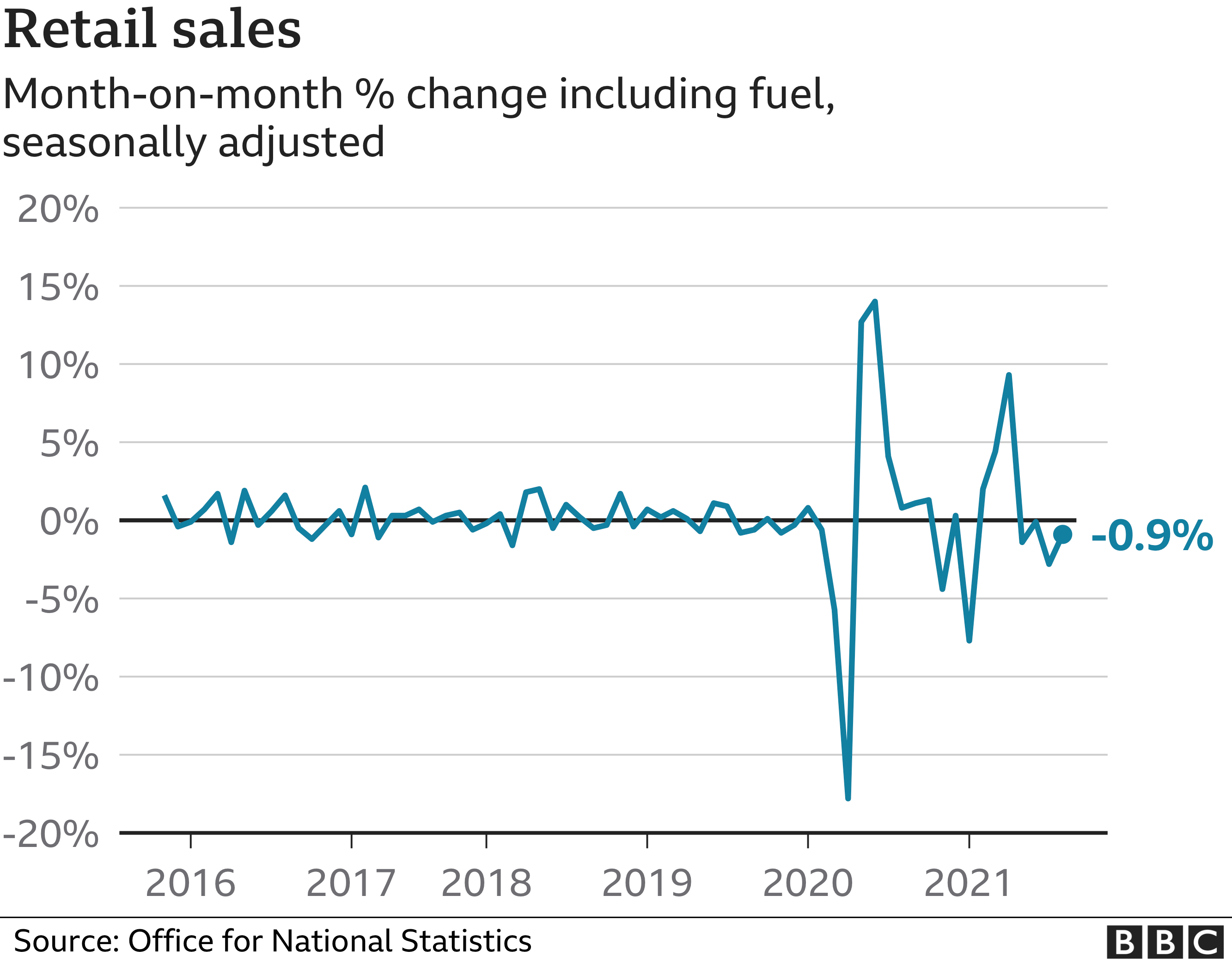

Deals fell by 0.9% in August, the Office for National Statistics (ONS) said, following a 2.8% fall in July.

Food store deals fell by 1.2%, yet the ONS said this was connected to the evacuation of limitations on friendliness prompting more individuals eating out.

Examiners said work deficiencies and production network interruption had harmed deals.

Sarah Coles, individual budget examiner at Hargreaves Lansdown, said customers and shops were “obstructed by deficiencies in August”, however added individuals “rediscovered our enthusiasm for a major night out”.

“Keeping the racks full was a genuine fight, particularly for retail chains, which is one justification for why we spent less in these stores in August,” she said.

“General stores had a battle on their hands to keep supply chains streaming, however the might of these retailers implied they had the option to find elective providers so we could continue to fill our streetcars.”

The portion of online deals expanded to 27.7% in August from 27.1% in July, the ONS said, significantly higher than the 19.7% offer found in February 2020 preceding the pandemic.

Jonathan Athow, ONS delegate public analyst for financial insights, said the fall in August’s deals was “not close to as much as in July” and, in general, stayed above pre-pandemic levels.

“Different information recommend that the drop in food stores’ deals is connected to an increment in eating out after the lifting of Covid limitations,” he said.

The ONS said a review investigating retail supply chains found 6.5% of all retail organizations said they couldn’t get the materials, labor and products required from inside the UK over the most recent fourteen days.

Retail chains revealing being the most influenced by interruption (18.2%), trailed by dress stores (11.1%).

Supply chains have been just barely gotten by the lack of truck drivers, prompting numerous organizations confronting delays in item conveyances.

The absence of truck drivers has been a drawn out issue, in any case, the Covid pandemic, Brexit and duty changes have exacerbated the issue further lately.

Recently, Ocado turned into the furthest down the line grocery store to report it was offering advantages to truck drivers, after it said higher wages and sign-on rewards would cost the online general store up to £5m.

Lynda Petherick, head of retail at Accenture UKI, said work deficiencies and production network disturbance had weighed intensely on the area, which was “described by pictures of exposed shop retires and postponed conveyances”.

“Retailers will as of now be worried as we head into the Golden Quarter as the pony might have darted for organizations who haven’t effectively acted to sure-up their inventory chains,” she added.

“Request satisfaction and getting stock will be testing, while many brands could wind up short-staffed throughout this active time. Without careful arranging, purchasers might be compelled to get imaginative this Christmas if retailers can’t address their issues.”

Martin Beck, senior monetary counselor at EY said the fall in deals was an astonishment, “considering that both footfall and charge and Visa spending had improved” in August.

“That deals have kept on falling is probably going to mirror the proceeded with standardization of expenditure designs, with retail request adversely influenced despite more noteworthy freedoms for social utilization,” he said.